11 Construction Industry Trends to Watch (2025-2028)

Construction is the fifth-largest industry in the world in terms of the number of people it employs.

And it makes up about 4.5% of US GDP.

But it is also one of the slowest growing.

However, new construction technologies are looking to speed up the rate of change.

Read on to learn about some of the most important trends in the construction industry.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

Top Stats

- 82% of US construction firms have an AI strategy

- The modular construction market is worth over $100 billion

- Saudi Arabia has spent more than $50 billion on its NEOM smart city

- China produces 700 tons of carbon emissions just from cement production

- 1 in 5 workplace deaths occur in the construction industry

- The US needs 439,000 extra construction workers to meet demand in 2025

1. Construction Embraces AI

Around 350 million people worldwide work in the construction industry. That's more than in government or healthcare.

It's among the top 10 industries in the US by GDP. And it is increasingly adopting a variety of new technologies.

Many of these technologies involve AI.

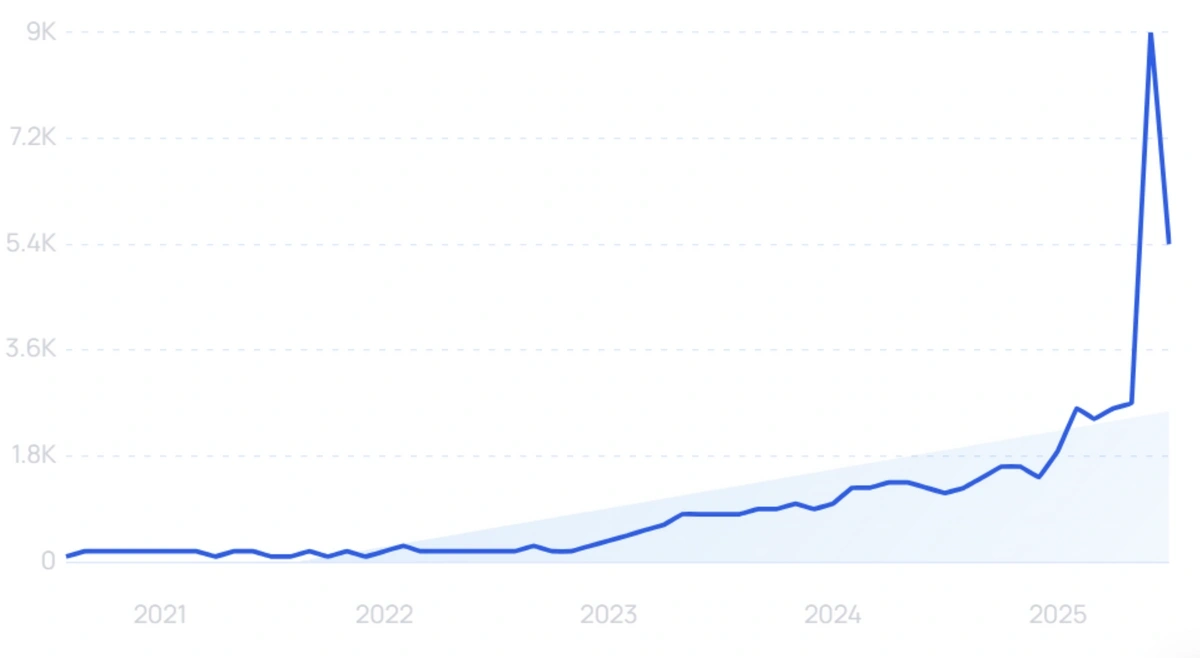

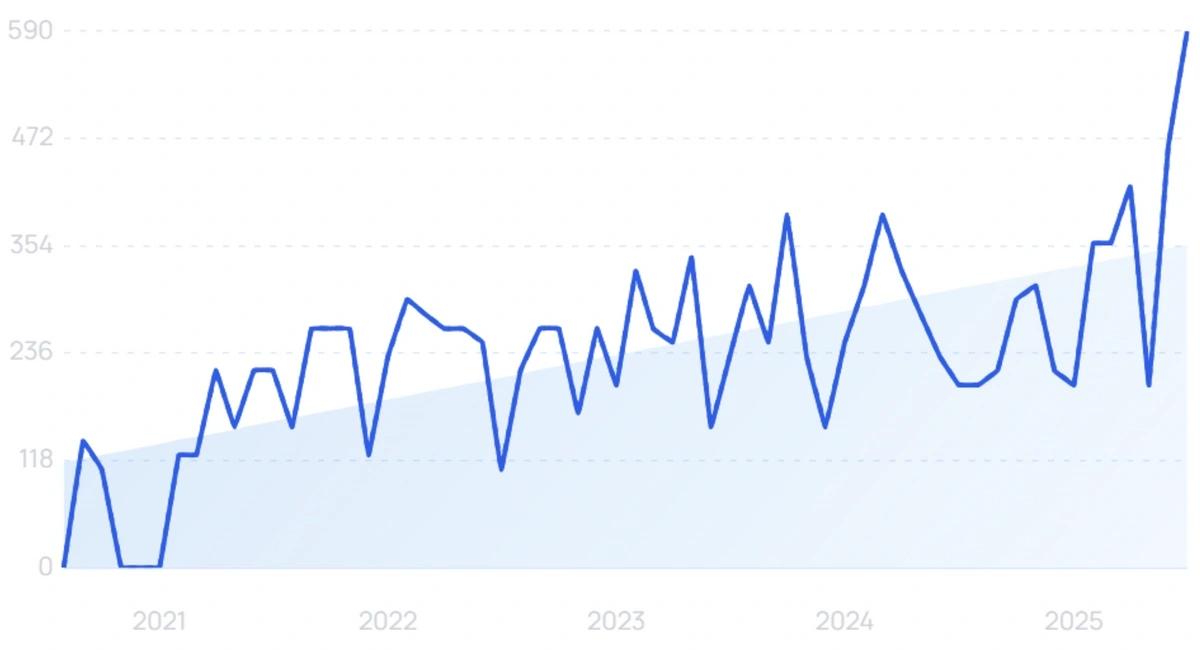

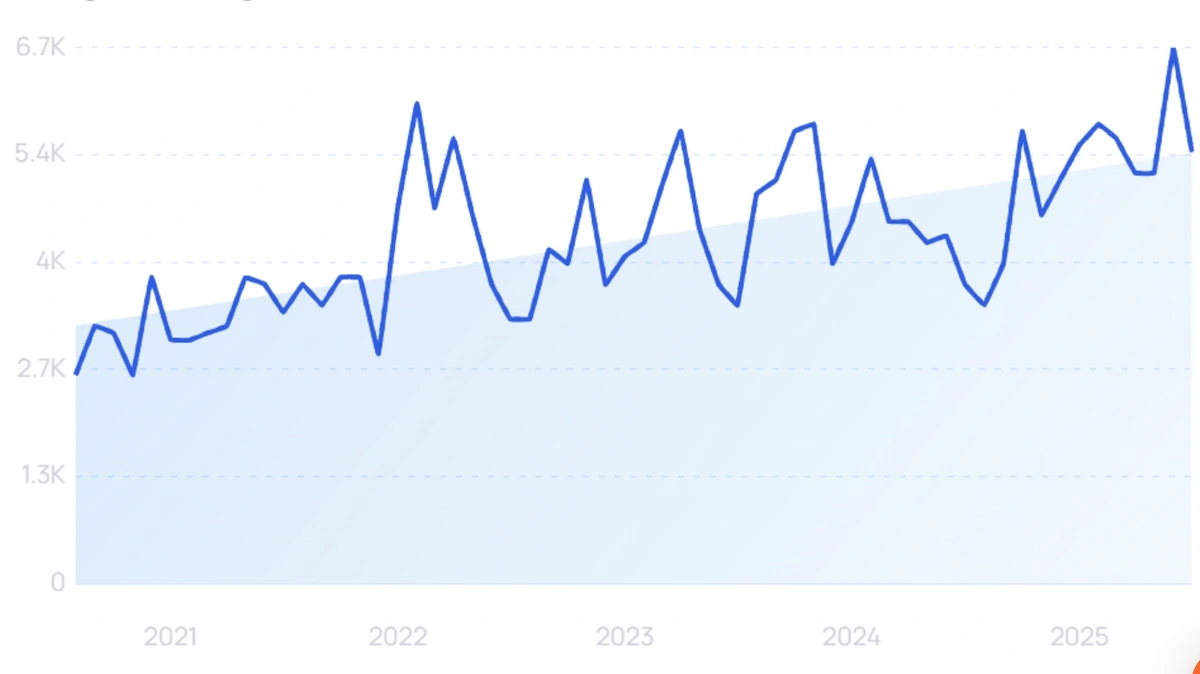

"Construction AI" searches are up by 5900% in the last 5 years.

Per the Harvard Business Review, AI has led to a flood of VC investment in construction tech, outpacing the overall VC indsutry 15-fold.

AI tools can variously enhance planning and design, reduce costs, increase productivity, and help with quality control.

That's why 82% of US construction firms already have an AI strategy. However, the majority are at an early stage of integrating the technology, which presents huge opportunities.

One major area of innovation is AI-powered monitoring and progress tracking on construction sites.

Buildots generates a virtual site map of the construction project and couples that with a Detailed Execution Plan. It then uses predictive analytics to flag potential delays and problem areas.

"Buildots" searches are up by 261% in the last 5 years.

The software can reduce delays by as much as 50%.

Similar tools can also assess and improve site safety, reducing workplace accidents by 25%.

Ultimately, we may also see increased use of AI to help physically complete construction work.

Skilled manual labor is some of the most resistant to automation. But with the construction industry requiring 439,000 net new workers in 2025 just to meet anticipated demand, technological solutions would be very welcome.

PulteGroup ran a pilot in Texas last year that employed AI-powered robots to assist in assembling pre-fab house modules. Total construction time went down by 30%.

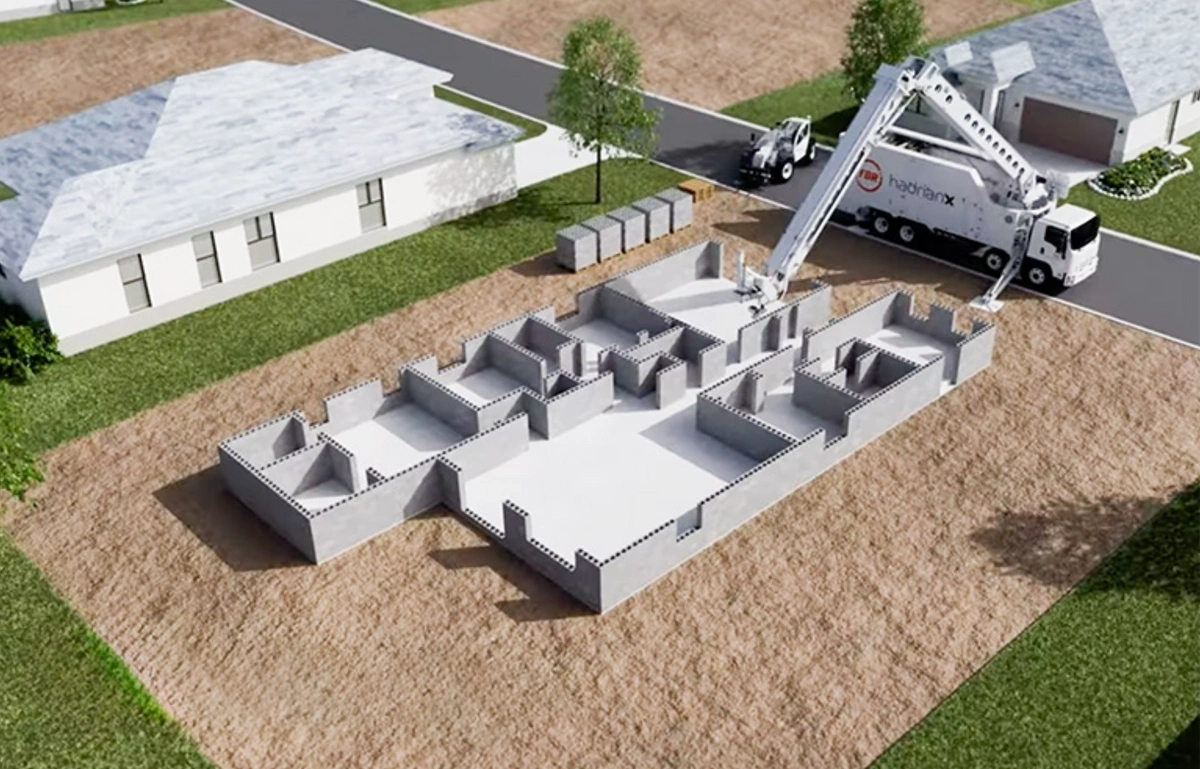

Meanwhile, Australian company FBR has developed HadrianX, a robot that can lay 300 bricks per hour.

2. The Virtual Construction Market Sees Rapid Growth

Virtual design and construction (VDC) describes the growing use of virtual environments to engineer and visualize the construction of structures before they're actually built in the physical world.

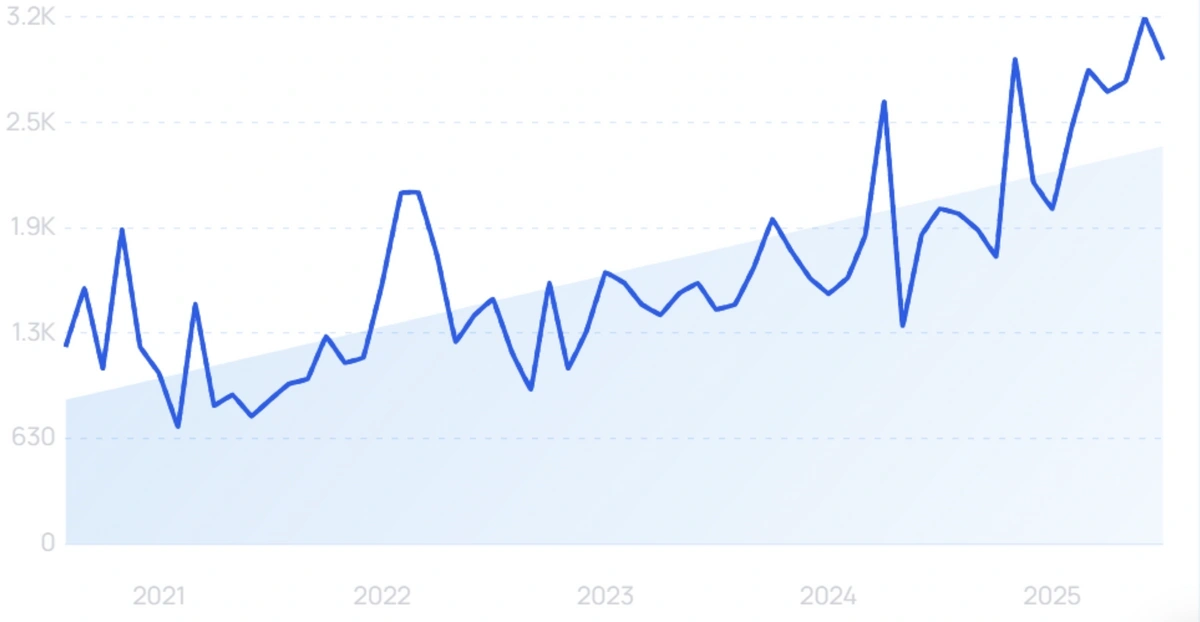

"Virtual design and construction" searches are up by 146% in the last 5 years.

These virtual environments can be accessed via desktop, and mobile devices, along with augmented and virtual reality hardware.

And there’s no wonder why this is catching on.

It’s estimated that the direct cost of error is 5% of the average construction project. Factoring in indirect costs, that rises as high as 25%.

Virtual design helps cut down on this by allowing builders to first build structures in a virtual environment.

Building Information Modeling (BIM) is probably the most popular VDC tool.

It allows architects, engineers, or anyone else to generate a virtual model of a physical building or structure

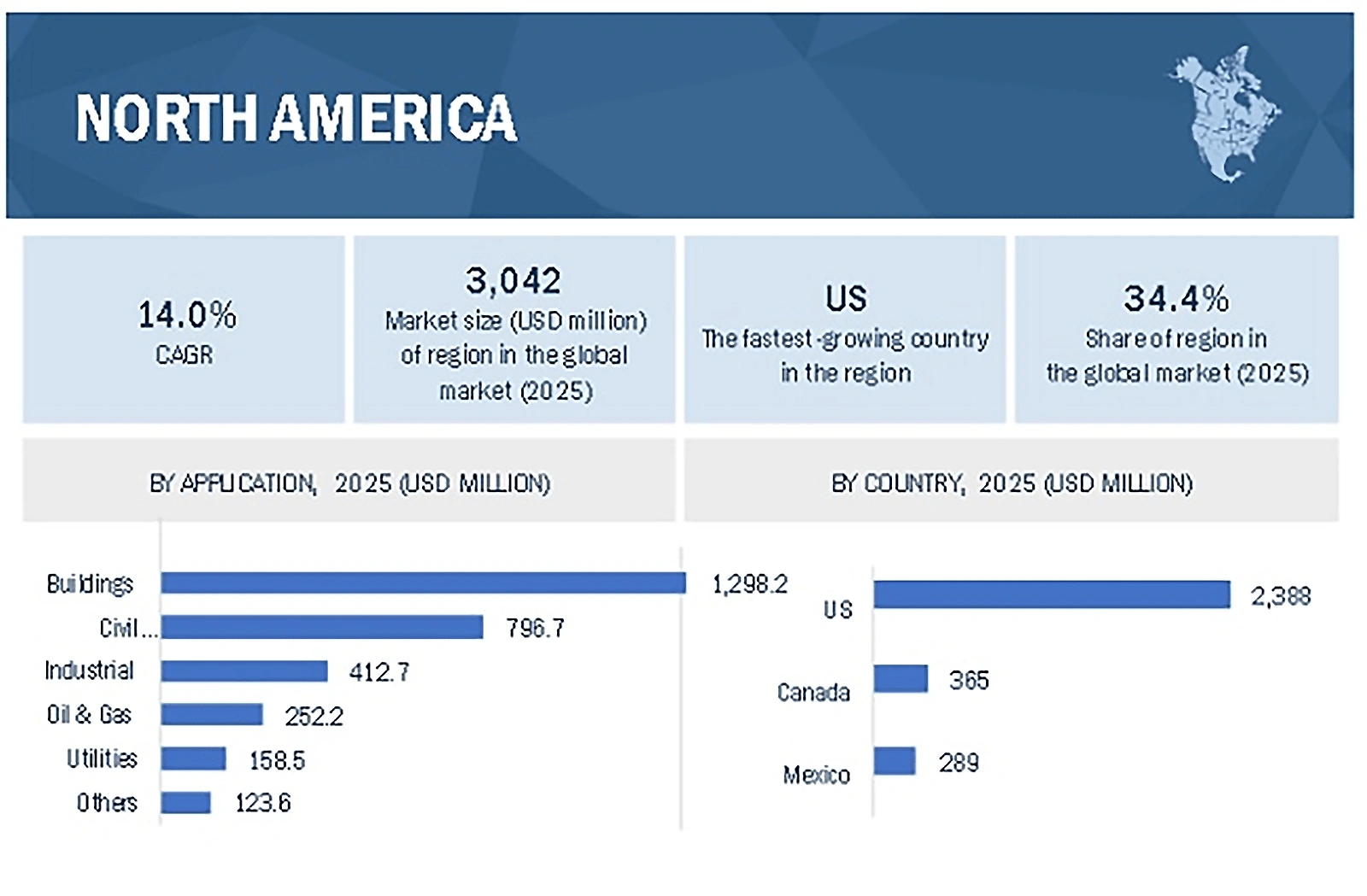

As of 2025, the BIM market is worth $7.92 billion and is expected to grow to $21 billion by 2034.

The construction industry took somewhat of a hit during the pandemic.

But it is expected to rebound over the next few years.

North America is expected to be the market leader over this time period, capturing over 30% of the market.

Expected growth and market share of the North American BIM market as of 2025.

McKinsey found that BIM technology has now achieved an adoption rate of about 60-70%.

However, this adoption has been relatively slow, taking about 35 years.

The last decade, though, offers some hope.

Today, over 73% of construction processes use BIM.

Compare this to 2011, when almost half of all NBS respondents had never heard of BIM.

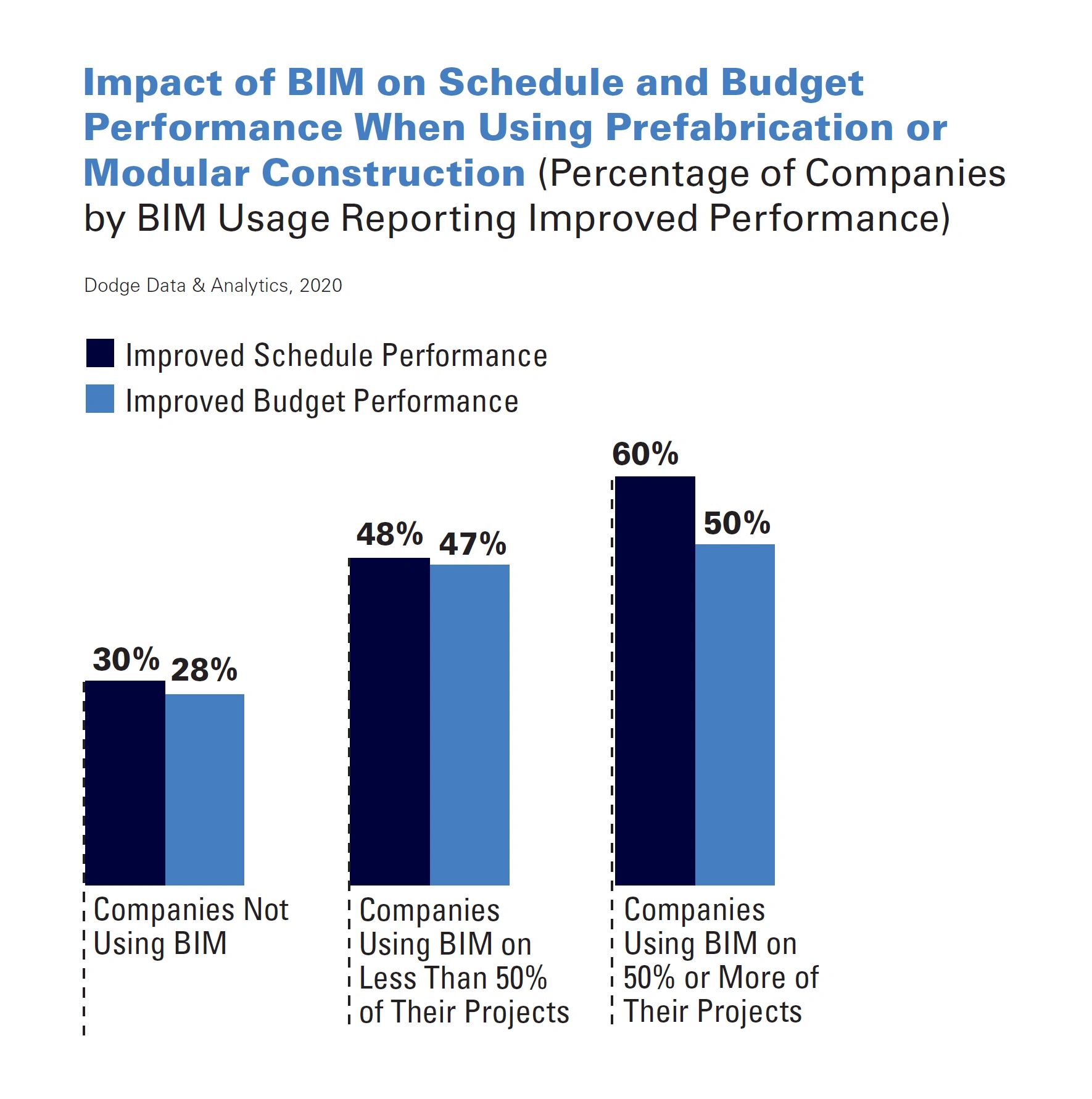

Combined with modular construction and prefabrication, BIM is consistently helping construction firms maintain budgets and keep tight construction schedules.

Source: Dodge Data & Analytics

A 2025 study found that BIM adoption reduces project timelines by an average of 20%, and cuts costs by 15%.

Construction Management Software (CMS) is also now an important tool for many major construction companies.

Search growth for "construction management software" is up 111% in 5 years.

A construction project is a very fragmented procedure. There are typically a variety of parties involved. And there are a lot of tasks happening at once.

CMS helps construction managers by allowing them to store and access data, blueprints, and documents all in one place.

The global construction management software industry is estimated to be worth $10.64 billion.

It is expected to grow to $16.62 billion by 2030 (a CAGR of 9.33%).

Autodesk is the largest player in the architecture and construction software market.

The company brought in over $6.35 billion in 2024 revenue.

Its AutoCAD, BIM 360, and REVIT technology are basically the standard in virtual modeling.

Its traditional AutoCAD software has a 37% share of the CAD (Computer Aided Design) market.

Autodesk’s software consistently ranks at the top of industry best lists.

Autodesk also gets over 26 million monthly website visits, according to Semrush data.

Want to Spy on Your Competition?

Explore competitors’ website traffic stats, discover growth points, and expand your market share.

3. Prefabrication and Modular Construction Change How Structures are Built

Modular construction typically involves constructing at least 60-90% of a building or other structure before bringing it to the construction site.

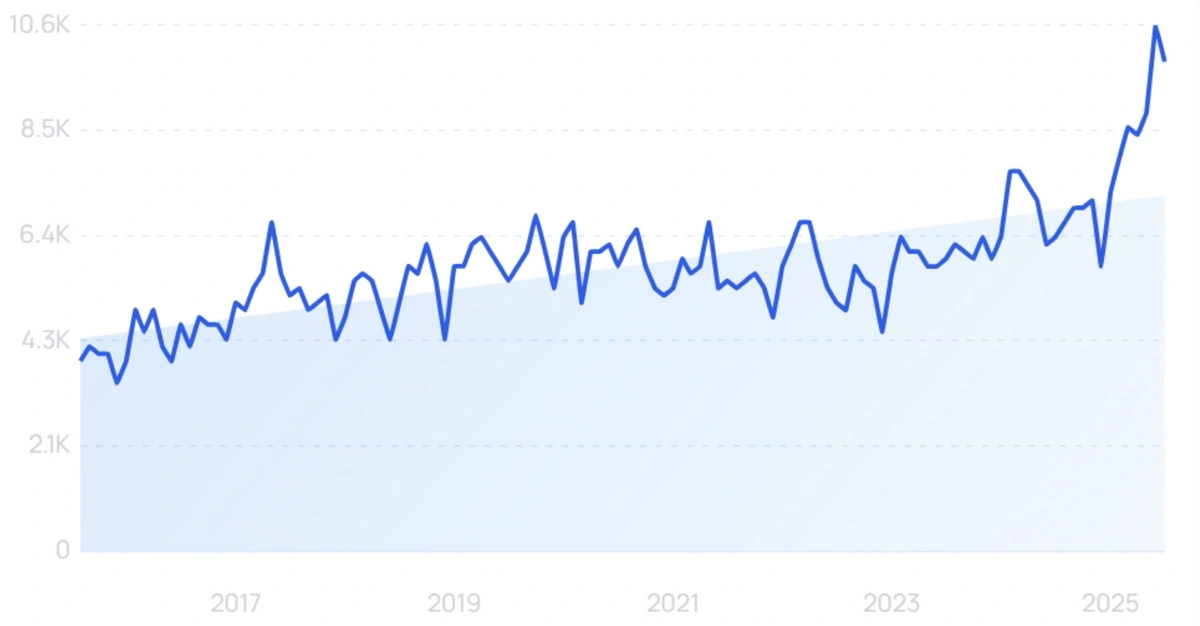

Search interest in “Modular Construction” is up 158% over 10 years.

Prefabrication, while technically part of modular construction, occurs when certain components of a structure are assembled or manufactured off-site.

The prefabricated parts are then easily affixed to the building.

The global modular construction market was worth about $104 billion as of 2024. And it is expected to grow to $140.8 billion by 2029.

Modular housing development in Oakland, California.

And while it has been relatively small compared to the entire construction market, the modular construction industry has experienced rapid growth in the past few years.

McKinsey estimates that the North American permanent modular construction industry’s share of new construction projects rose by 51% between 2015 and 2018.

Over the same period, the industry’s total revenue more than doubled.

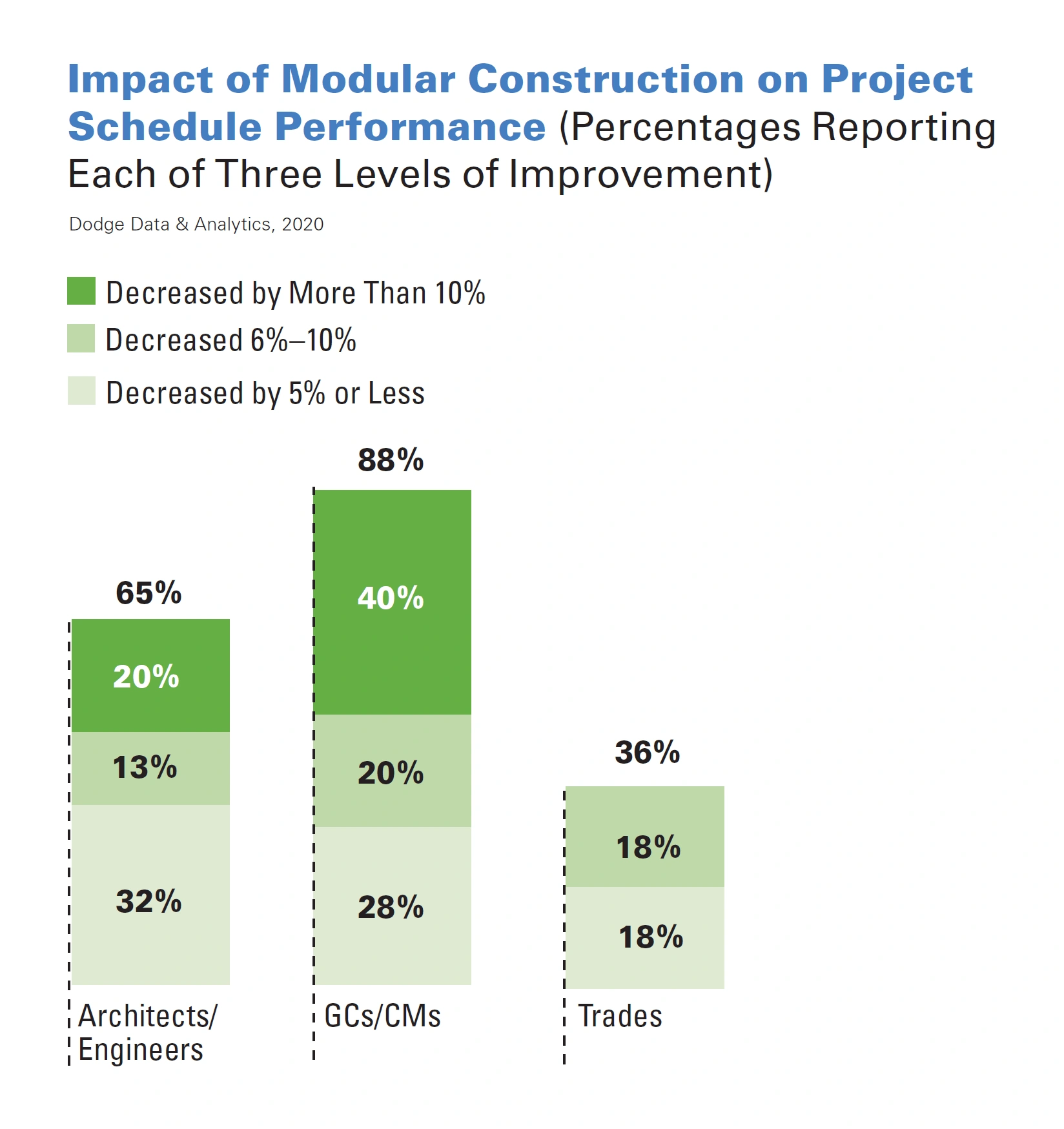

Increasingly, general contractors (GC’s), architects, and developers are finding that prefabrication and modular construction helps keep costs low, shortens the construction timeline, and reduces waste.

Source: Dodge Data & Analytics

Source: Dodge Data & Analytics

Because of this, roughly 90% of respondents to Dodge’s 2020 Prefabrication and Modular Construction Report said that prefabrication and modular construction methods were more beneficial than traditional construction.

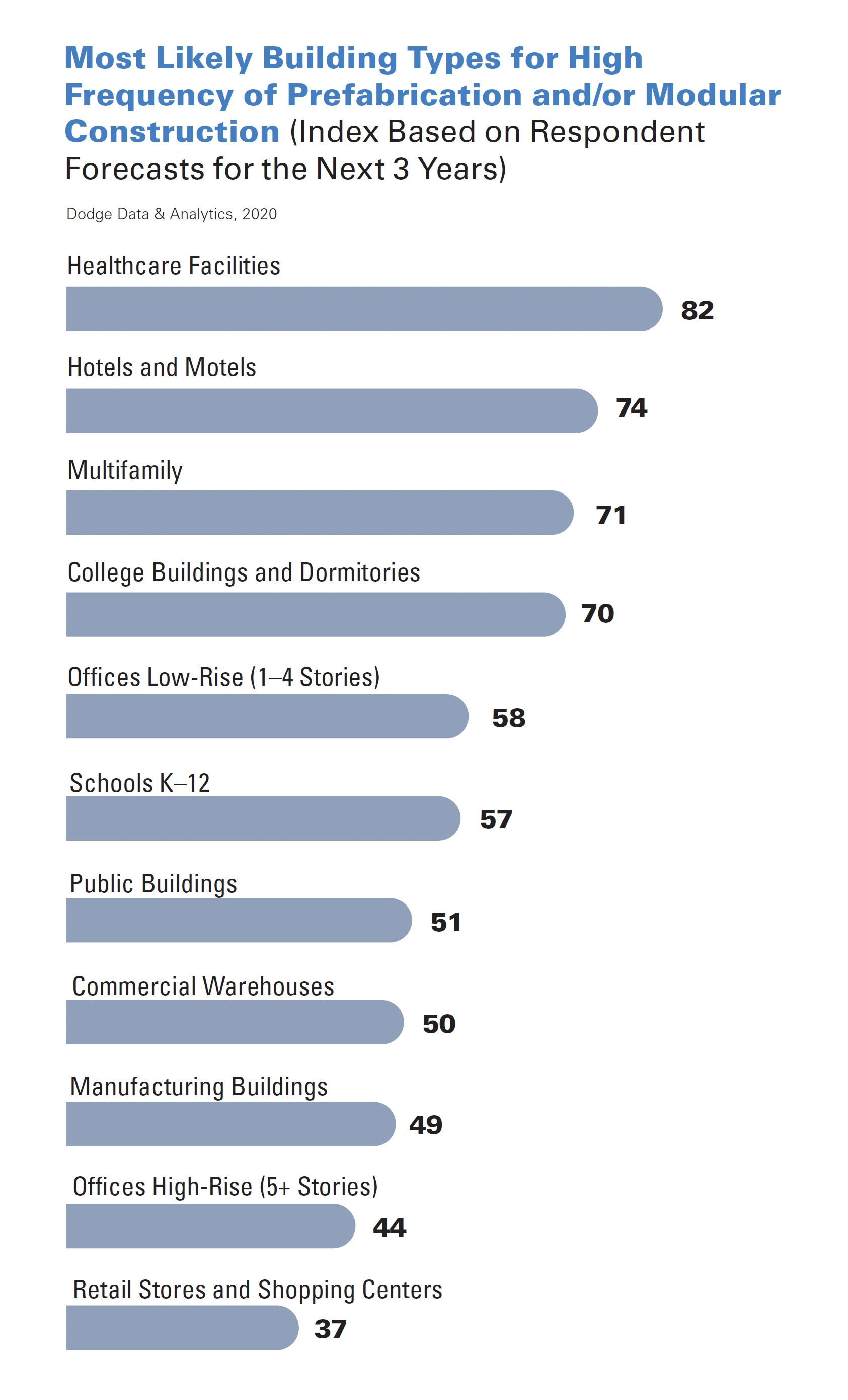

Certain kinds of buildings do, however, lend themselves better to this kind of construction.

Dodge found that, overall, healthcare facilities are expected to benefit the most from modular construction and prefabrication over the next three years.

Hotels and motels, as well as multifamily residential structures, didn’t trail far behind though.

Source: Dodge Data & Analytics

Between 2018 and 2020, hotels and motels led the pack as major beneficiaries of modular construction.

According to Dodge, roughly 43% of architects and engineers and 29% of general contractors and construction managers said that hotels and motels were the fastest-growing industry for modular construction.

And in 2024, data centers were a new entrant as a major driver of growth in modular construction. Here are the key modular construction market segments driving growth in the US:

| Building Type | Market Size (US, 2024) | Projected Market Size (US, 2029) | CAGR |

| Multifamily residential | $7.1 billion | $11.3 billion | 4.7% |

| Office/data centers | $1.4 billion | $2.0 billion | 7.1% |

| Lodging | $577 million | $1.1 billion | 9.2% |

Regionaly, the West of the US is taking the lead on modular construction:

- West: $7.5 billion market. California a leading market, driven by high demand for housing and tech/data centers.

- Northeast: $4.5 billion market. High adoption in education and housing, especially in dense urban areas.

- South: $4.4 billion market. Lodging, pad retail, and housing all present opportunities.

- Midwest: $4.0 billion market. Education, rural healthcare, and manufacturing are all adopting modular construction.

As the modular construction market grows, it is attracting new entrants.

Boxabl announced recently that it would go public on the Nasdaq in a $3.5 billion merger with a SPAC.

4. Smart Cities Change the Way Construction Companies Operate

One of the biggest trends affecting the construction industry is the rise of smart cities.

A smart city is a city that is basically fully integrated with the Internet of Things (IoT).

The infrastructure and buildings all assist in collecting data to help everything run more efficiently.

It’s estimated that the global smart city market is worth $877.6 billion.

That figure could rise above $3 trillion by 2030, with a projected CAGR of 29.4%.

As this concept matures, it will likely change the way most of the construction industry operates.

More and more construction industry participants will have to start using tech advancements like IoT in their building materials.

IoT adoption in the construction industry is at an all-time high, and increasing by 25% each year.

And 60% of construction business to have adopted IoT technologies have reported efficiency increases of 70%.

The construction industry will have no choice but to adjust soon, as large corporations and cities are making agreements to construct smart cities within the next year.

Toyota completed Phase 1 of construction on "Woven City" in late 2024, and is scheduling a fall 2025 launch.

The company plans to test mobility innovations in an environment with actual citizens.

A digital representation of Toyota’s “Woven City”.

And of course, there is Saudi Arabia's NEOM project. The Saudi government has spent more than $50 billion so far on realizing its vision of a smart city.

Details remain somewhat sketchy. But NEOM will apparently focus on "5G hyperconnectivity, AI and advanced robotics, augmented and virtual reality, and purpose-built data centers."

5. Green Building Helps Tackle Environmental Issues

Green building involves building environmentally sustainable buildings using an environmentally sustainable construction and design process.

"Green building" searches are up by 63% in the last 5 years.

As governments and regulatory bodies around the world focus on environmental factors in every industry, more construction and design firms are implementing green building methods.

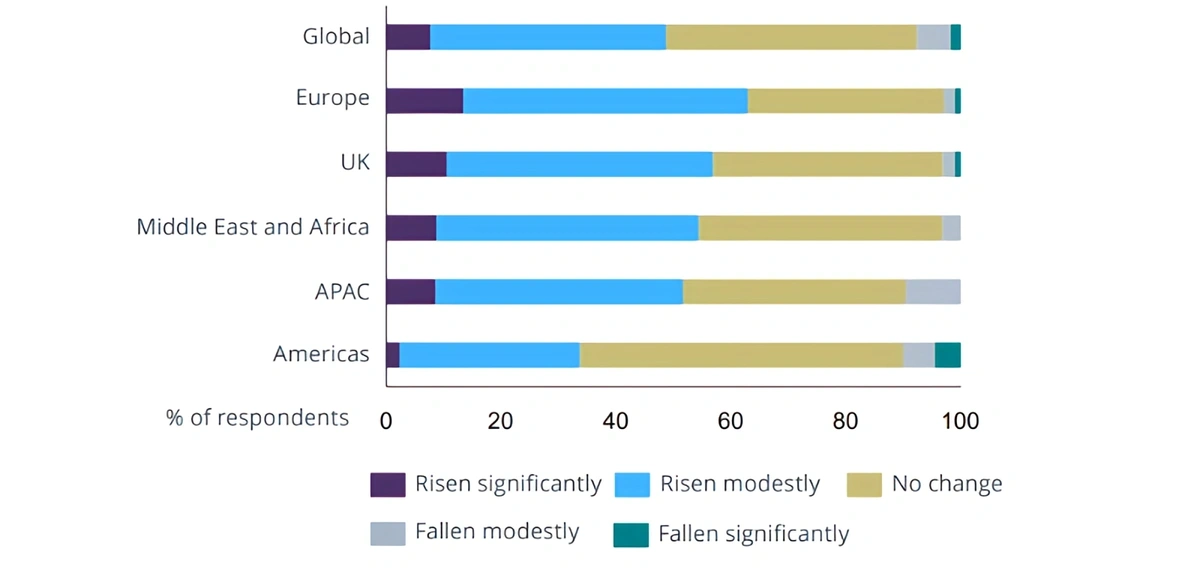

The RICS Sustainability Report 2024 found that almost half of respondents reported at least a modest rise in demands for green buildings in the past 12 months.

Europe led that trend, with more than 60% of respondents noting a rise in demand for green building.

Source: RICS Sustainability Report 2024

The green building revolution is doing particularly well in the residential building market.

Over one-third of single-family and multi-family builders build at least half of their projects using green building techniques.

Energy efficiency is widely regarded as the top practice of home builders in improving green home performance. In fact, 96% of green home builders build their homes to be energy efficient.

This makes sense, considering building operations themselves account for the vast majority of greenhouse gas emissions in the construction and real estate sectors.

Because of this, over 90% of single-family residential builders said they used some kind of energy efficiency practices in the construction of at least some of their buildings. 69% claim they use it in most of their buildings.

6. Living Building Materials Go Mainstream

One of the most radical new trends in the construction industry is the use of living building materials.

Searches for “living building material” have increased by 76% over the last 5 years.

This part of the industry is still very young, but there are signs of increased adoption.

When looked at from an environmental standpoint, the decision to switch to this kind of material is clear.

The entire construction supply chain accounts for 11% of global greenhouse gas emissions.

And embodied carbon (carbon released in the construction process) accounts for close to 30% of greenhouse gas emissions in the construction and real estate sectors.

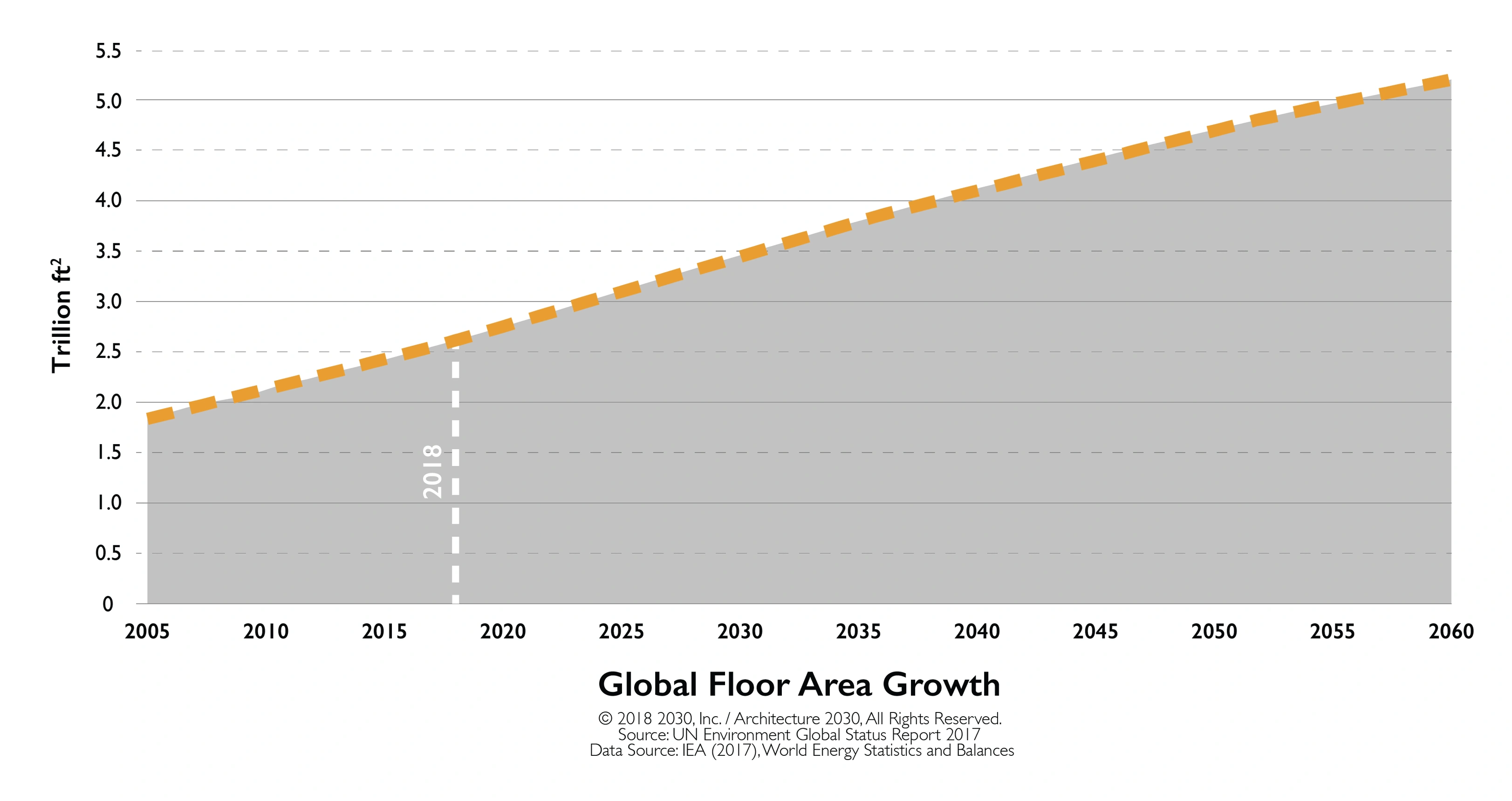

The number of new buildings being built also isn’t expected to slow anytime soon.

To accommodate growing populations, the global building stock is expected to double by 2060.

Expected global floor area growth.

Cement is one of the main areas targeted by the living material sector.

Cement production alone accounts for 8% of global CO2 emissions.

And emissions will need to fall by 16% before 2030 for the sector to come in line with the Paris Agreement on climate change.

According to the BBC, if the cement sector were a country, it would be the third-largest carbon emitter, behind China and the US.

China itself leads the way on carbon emissions from cement, producing over 700 million tons per year. The US, by comparison, generates around 40 million tons.

That’s why new products like self-replicating concrete and self-mending biocement are being developed.

Biocement is grown using biological materials instead of created from non-renewable materials. And the process actually absorbs CO2 instead of emitting it.

Innovations like this can allow “manufacturers” to grow building materials that self-replicate, making it much easier and more efficient to scale.

BioMason Inc. is one of the most interesting companies in this area.

The company was founded in 2012, and it uses biological processes to grow biocement blocks.

A Biocement block grown by BioMason.

BioMason raised $36 million in new capital in early 2025, having appointed a new CEO. It had previously raised a $65 million round in 2022.

7. The Construction Industry Benefits Heavily from Drone Technology

Another way that the construction industry is becoming more efficient is through the use of drone technology.

Once thought of as novelty items, drones are now responsible for huge cost savings on major construction projects.

It’s estimated that drone usage has significantly cut down on the annual $177 billion in waste that occurs on construction sites.

In fact, using drones to measure stockpiles of building materials in real time has resulted in a 61% increase in measurement accuracy.

Many are hoping drones will significantly reduce construction worker injuries and deaths.

In the US, 20% of workplace deaths occur in the construction industry – an industry that only makes up 6% of the US labor force.

By using drones, construction companies are able to survey and inspect various locations without putting any actual humans in harm’s way.

As a result of drone technology, the construction industry has seen a 55% increase in safety standards.

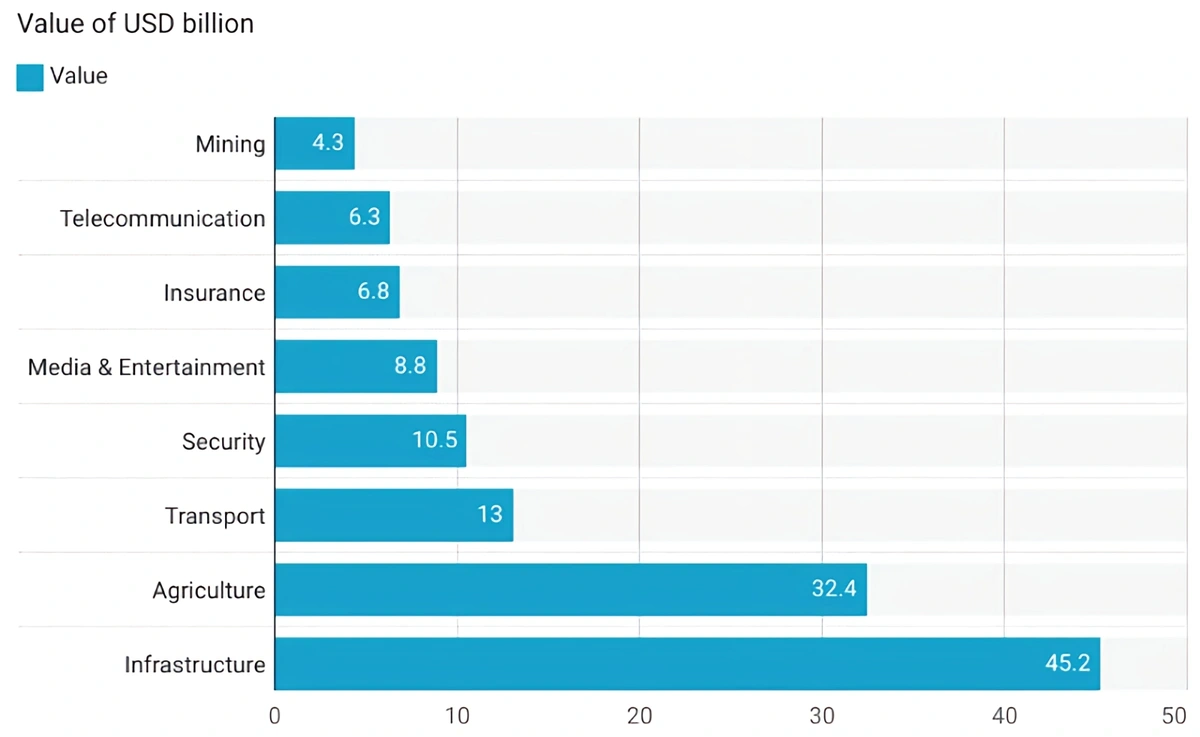

A 2025 Market.US report found that the infrastructure industry is the largest market for drones by some distance.

8. Tech Solutions Improve Safety

Concerns about construction site safety are on the rise.

Search volume for “construction safety equipment” has shown growing interest in the past 5 years.

In the US, around 1 in 5 workplace deaths occur in the construction industry. It costs more than 1,000 lives a year.

In the UK, fatalities in construction made up 37% of all worker fatalities in 2023/24. That marked a joint 10-year high.

Statistics like this are leading to a call for improved safety equipment using tech.

Hard hats have been one of the most prevalent pieces of safety equipment at construction sites for the past several decades. However, there’s now a “helmet revolution” taking place in the industry.

Safety helmets, like the ones you see people wearing while rock climbing, are becoming popular for a number of reasons.

For example, because they have a chin strap, they stay on even if the worker falls.

They also provide a greater field of vision and a more compact, ergonomic fit for the user.

Many of the latest developments in safety helmets focus on reducing impact in order to prevent injuries to the head and neck.

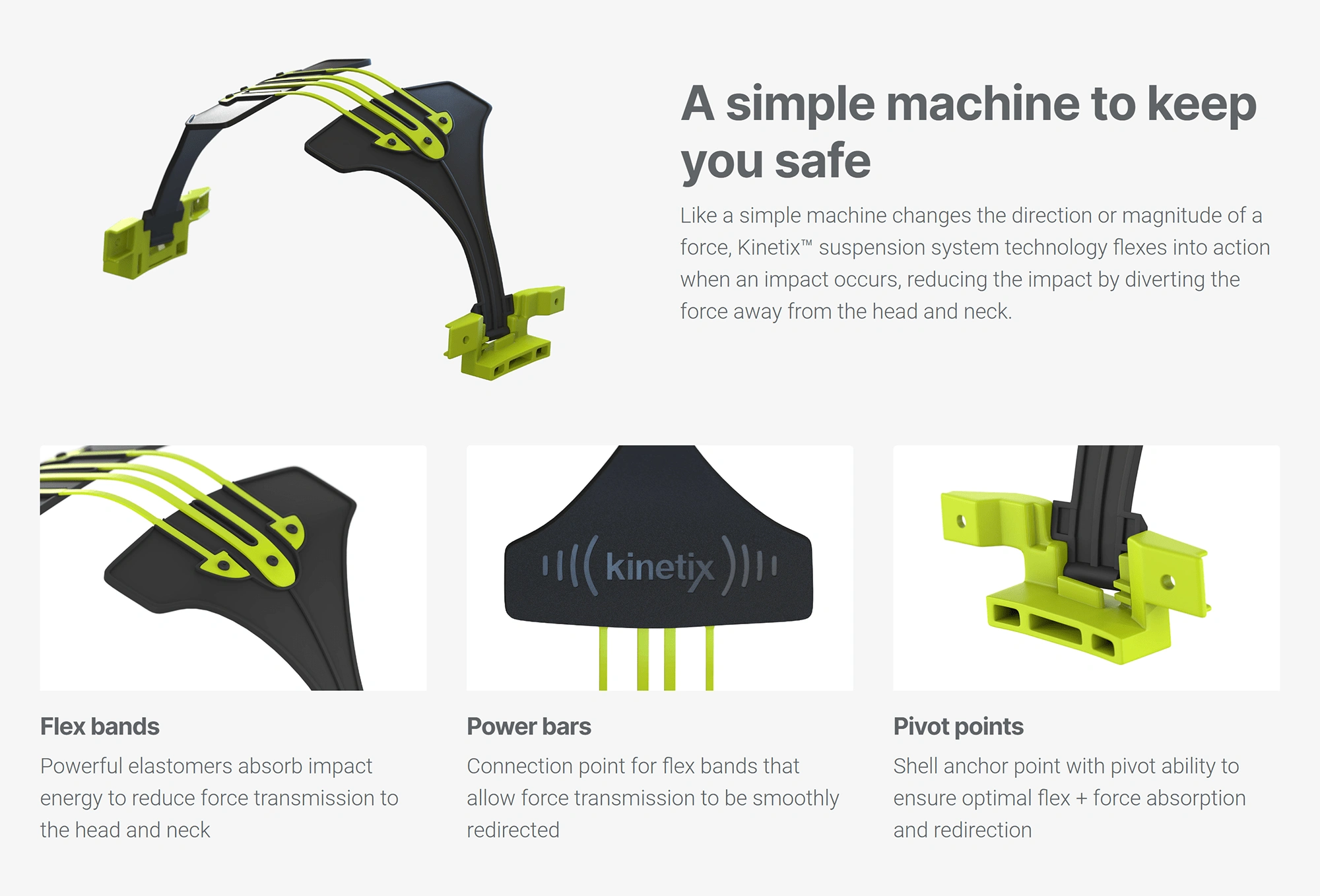

One helmet from HexArmor features a Kinetix suspension system that’s able to absorb and direct impact out and away from the neck and spinal cord. When compared to other helmets, this system reduces 40% more of the impact force.

The Kinetix suspension system is a high-tech way to protect construction workers from impact in the case of a fall.

There are even some safety helmets, like those offered by twICEme technology, that integrate the user’s medical information, emergency contact information, and coordinate directly into the helmet.

Since twICEme technology works via NFC technology, no GSM, wi-fi, or 3G/4G/5G is needed for communicating.

Wearables are another example of tech-enabled safety equipment that’s becoming popular on construction sites. These could include:

- Smart helmets

- Wearable sensors to track body temperature, heart rate, falls etc

- GPS trackers

- Smart vests for temperature control, stress/strain/posture analysis etc

- Exoskeletons to support physically intense work

- Smart goggles

9. Construction Firms Face Major Labor Shortage

The construction industry has been facing a labor shortage for the past several years. But in 2025, it has firmly reached "crisis" level, according to Construction Today.

Search volume for “construction labor shortage” is up 99X+ in the last 5 years.

In addition to needing 439,000 workers to meet growing demand, the construction industry also has to confront a rising age crisis. In the US, the average worker in the industry is now over 42 years old.

Alarmingly, 41% of the workforce will retire by 2031.

The shortage of workers is impacting project timelines and completion rates.

In a recent survey, 94% of construction firms reported having difficulty in filling positions. More than half of contractors have experienced delays due to workforce shortages.

The National Association of Home Builders says the lack of construction workers is a main factor in the shortage of housing inventory and affordability. It amounts to roughly 19,000 lost single-family homes per year.

The aggregate economic impact of longer construction times associated with skilled labor shortage is $10.8 billion per year.

One industry analyst says there are 25% more unfilled positions than hired. He expects that “jobs that were predicted to cost $500 million end up costing $600 million because you’re going to need to pay people more”.

In addition to higher salaries, the industry is trying a variety of strategies in order to recruit and retain workers.

Some are launching programs to reach kids as early as grade school and get them interested in construction jobs.

Other firms are focused on diversity in hiring, attracting interest through social media, and offering retention bonuses.

One bright spot is enrollment in construction industry trades courses. Enrollment increased 19.3% year-over-year in recent data.

10. 3D Printing Use Increases

The construction 3D printing market is growing at an incredible rate. Reports show a CAGR of 111.3% from 2025 to 2030.

Search volume for “construction 3D printing” is up 107% in the past 5 years.

This type of 3D printing can use a variety of materials: concrete, geopolymers, fiber, sand, and others.

Some innovators have even used biodegradable materials, like mud, soil, and straw in 3D-printed houses.

In most instances, only the frame and walls of a building can be manufactured with 3D printing. However, technology is advancing so fast that plumbing and electrical fixtures can also be integrated into the building via 3D printing.

The construction industry stands to reap several benefits from 3D printing.

The first benefit is time-savings. Technology works faster than we do and California-based Mighty Buildings has the proof.

The company built its Mighty Duo B, a 700-square-foot 3D prefabricated home, in just eight weeks. And, it only cost $314 per square foot.

Mighty Buildings has several home layouts including this small dwelling, a 1,100-square-foot option, and a 2,000-square-foot home.

The company reports that its projects reduce construction timelines by up to 75%.

The lower price is another notable feature of 3D printing in construction.

Far less manpower and time is needed to build these structures, resulting in less wages paid.

One commercial building was built in Dubai using 50% less labor than a typical building.

Black Buffalo 3D, the provider of a large-scale 3D construction printer, says that using its machine to build a 1,000-square-foot space costs 40% less than traditional wooden frames that are built on-site.

ICON, a company that constructs homes using 3D printing, built a 650-square-foot home in 24 hours at a cost of $10,000. They say they’ll be able to get the price down to just $4,000 in the future.

Because of the cost-savings of 3D printing construction, Habitat for Humanity has been watching the trend closely.

The organization built its first 3D-printed house in Virginia in late 2021.

In addition to the walls, the cabinet fixtures and light switch covers were also printed with 3D technology.

They have a second 3D-printed home in Arizona. The organization says nearly 80% of the 2,400-square-foot home is made with 3D technology.

11. Construction Robotics and Automation Enhance Productivity

Reduced waste, improved safety, enhanced productivity, closing the workforce gap—early adopters in the construction industry are achieving all of these goals by employing robotics and other automation strategies.

Search volume for “automation in construction” is gaining interest, up 575% in the past 5 years.

The market for construction robots is expected to reach $3.6 billion by 2030.

A survey commissioned by ABB showed that more than half of construction companies are currently using robots and 81% expect to introduce robots within the next 10 years.

Construction firms are deploying robots to complete a variety of tasks on-site and off-site.

The TyBOT, a device that ties rebar, is one of the most popular construction robots.

Tying rebar without a robot requires workers to make repeated hand and arm twisting movements while stooping or bending at the waist. It’s literally back-breaking work.

TyBOT takes less than four hours to set up and ties rebar at a rate of 1,100 intersections per hour. That provides up to a 40% productivity boost compared to human labor. And, it reduces the occurrences of worksite injuries.

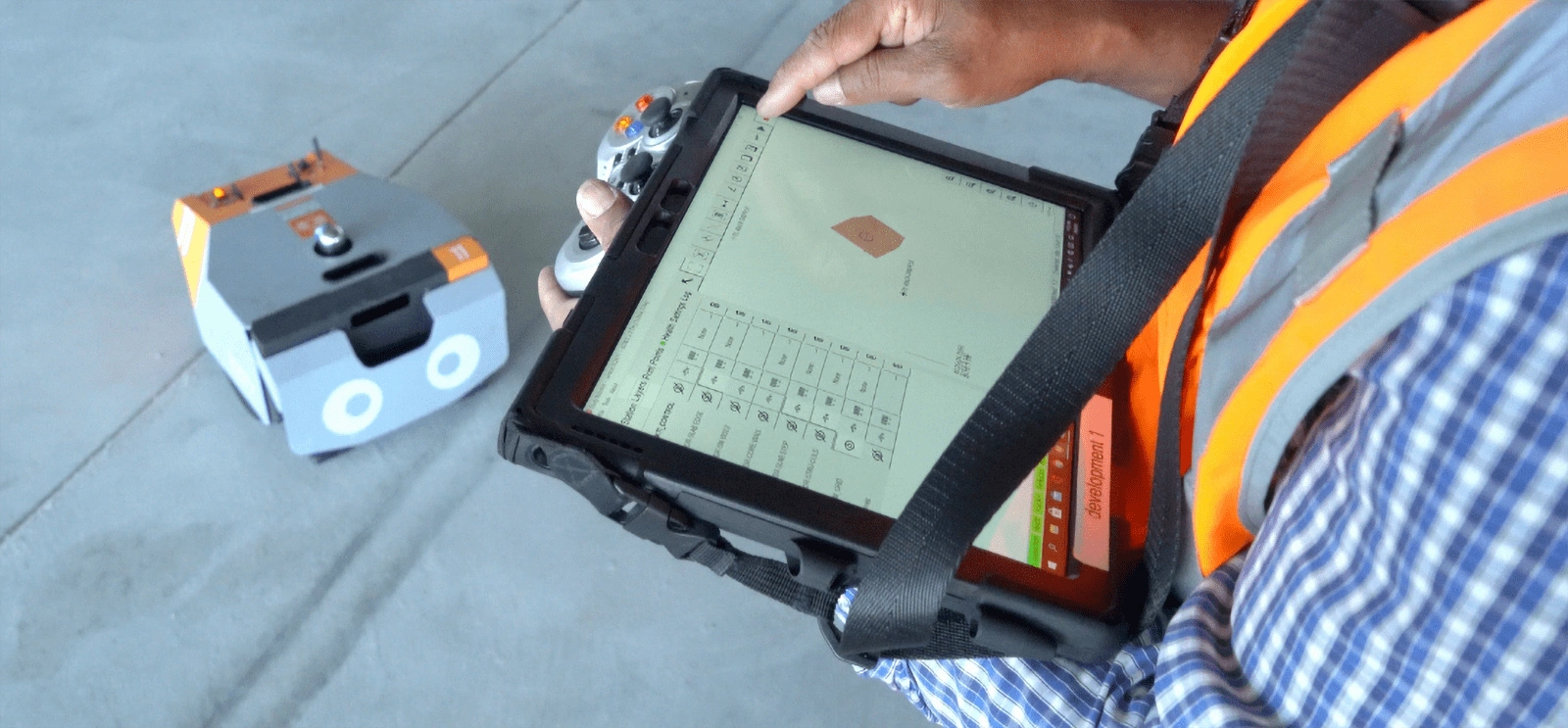

Another firm seeing success with construction automation and robots is Dusty Robotics.

The company’s FieldPrinter can autonomously mark layouts on the concrete slab of construction sites. The process usually involves workers manually measuring and using a chalk line to show where features should be in an interior construction site. The automated process is up to 10x faster than the traditional method.

It fully integrates with CAD and BIM models to mark specifications for all trades in a single pass. Only one operator and a tablet interface is required for operation.

The FieldPrinter prints points, text, and lines directly on concrete, plywood subfloor, or asphalt.

In June 2021, the company raised $16.5 million in a Series A funding round and followed that up with a $45 million Series B in May 2022, bringing the company up to a $250 million valuation.

Autonomous construction vehicles represent another large market.

In 2024, the autonomous construction equipment market was valued at $4.4 billion and is expected to grow at a CAGR of 14.2% through 2030.

Built Robotics, founded in 2016, develops software and hardware to automate construction equipment.

The company’s Exosystem installs on late-model excavators in just minutes. The vehicle is then geofenced in a specific area and monitors itself with a 360-degree camera. One trained operator can start the machine and walk away.

The system has a base cost of $3,000 per machine per month.

The Exosystem can be installed quickly and can also be detached from the machine as needed.

Built Robotics has raised $112 million to date.

Conclusion

That's about it for our list of important construction industry trends for the next few years.

Overall, environmental sustainability and software adoption seem to be the overriding themes that tie many of these trends together.

Interestingly, these themes also tend to result in cost savings. Which should help speed up the rate of adoption.

You may also like:

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more